OUR PROCESS

Process is the journey;

prosperity is the destination.

The journey of building your wealth, let alone reaching the very top is difficult as it is. If you have summited or still on the path, we at York believe all our journeys are improved by the company we keep.

We help to simplify the complex, plan a route, keep you on the path and spot rare opportunities as they come by.

Owning your financial security brings joy and the journey should be the same.

OUR PROCESS

Our highest priority is you

Our Process - Six Steps

1 - We begin our journey by discovering what matters to you

We start by getting to know you and/or your family on a personal level.

This is a comprehensive understanding of your financial position, your vision for your financial future, your family’s dynamics, and any potential emotional or physical roadblocks.

2 - Get the foundations right | Formulation of tax, legal structures & professional services

We believe a great advisory team is stronger than an individual superstar.

We can work alongside your existing professional advisors or give you access to our network covering:

Superannuation Administration

SMSF Audit

Accounting & Tax

Wills & Estate Planning

Legal

Insurance & Wealth Protection

Mortgage Broking

Real Estate

Property Development

3 - We create your strategic investment plan (IPS or SOA)

Your bespoke Investment Policy Statement (IPS) or Statement of Advice (SOA) reflects risk, opportunities, and taxation across multiple entities, while integrating your investing and estate plans.

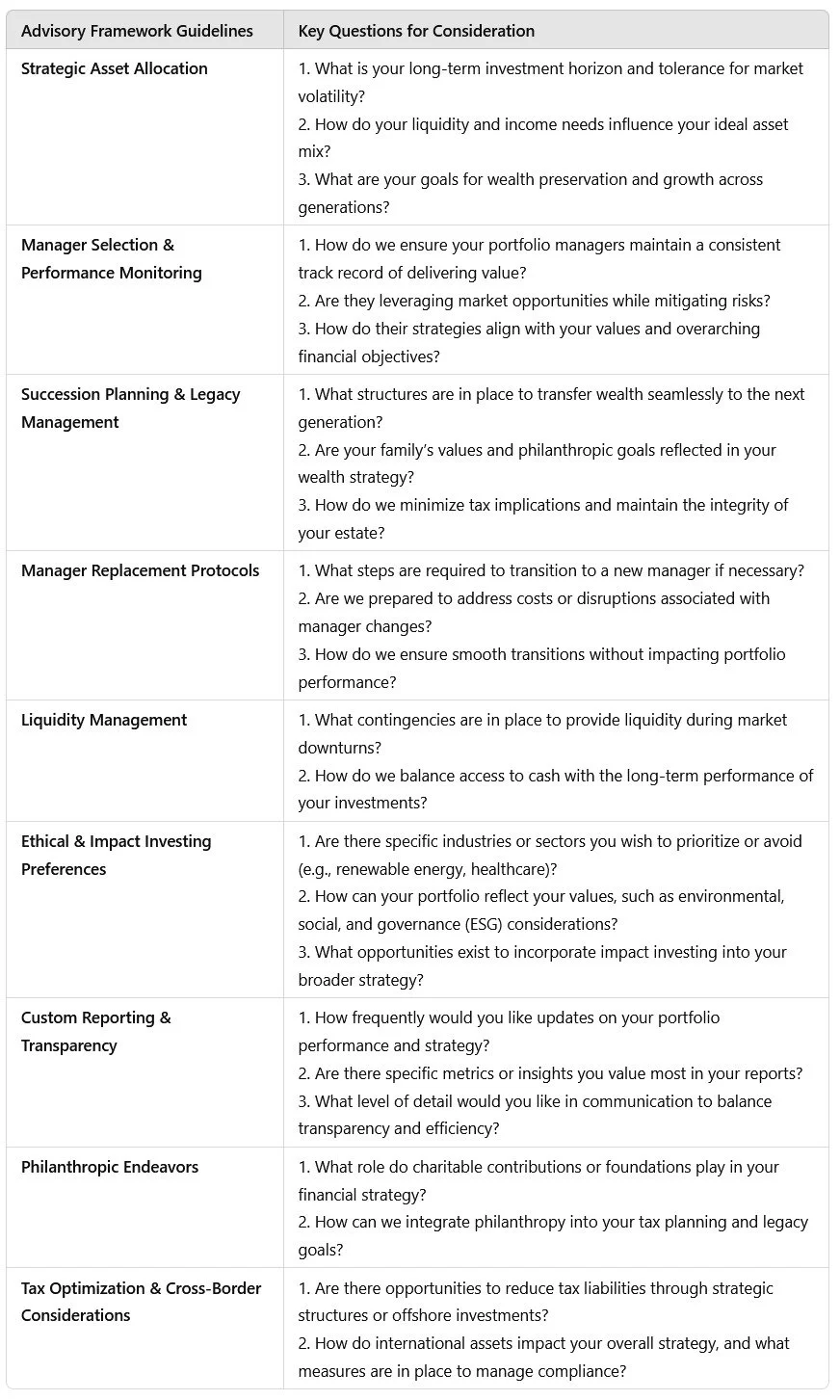

The IPS or SOA is the basis for all advice and is the framework to guide us when certain investment decisions need to be made.

4 - We create & propose investment recommendations

Your IPS or SOA is the core to formulating what specific assets and allocation weightings are right for you.

We are long-term investors and always advocate for diversified portfolios to reduce risk and maximize possible performance over time.

5 - Implementation of your financial plan

We will thoroughly explain the proposed plan and investment recommendations, the reasoning behind each strategy and, of course, answer any questions or make any adjustments. Once approved, we will implement the plan, keeping you constantly informed about activities while minimizing the amount of your valuable time taken.

6 - Ongoing investment review with you & your family

One of the only constants in life is “change.” We formally establish a review with you and your family throughout the year to ensure we stay on the right path.